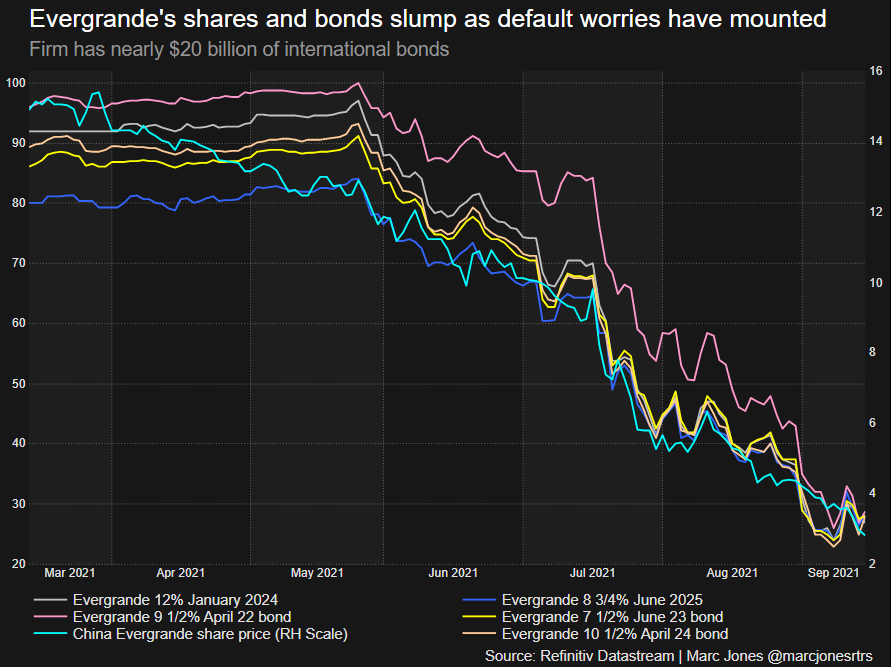

Guangdong's provincial government is also sending a working team to the company, which analysts at Jefferies said indicated a "potential takeover of Evergrande.Tomorrow is looming as crunch day for the beleaguered debt-burdened Chinese property developer Evergrande when interest payments on two bonds fall due.Įvergrande is up for a payment of $83.5 million in interest on an 8.25 percent five-year bond and a $36 million payment on another debt on the same day.įinancial markets have priced in the prospect of payment as unlikely with one of its bonds trading at less than 30 percent of its face value. Only two executives from the company are on the committee - others include officials from state entities. After Evergrande said on Friday that it may not be able to meet its financial obligations, the government summoned the company's founder and announced several moves that have given the clearest picture yet of Beijing's plans to end the crisis.Ī new seven-strong "risk management committee" has been set up to manage the restructuring. Signs now point to Beijing being willing to close the chapter on the 25-year-old real estate empire that has typified China's breakneck growth in recent decades.

CHINA EVERGRANDE BOND DEFAULT FREE

The Chinese government, meanwhile, has intervened to dismantle Evergrande in an orderly fashion, to avoid a spectacular crash that, in a worst-case scenario, could leave Chinese people who bought homes from the company high and dry.Īs "60 Minutes" correspondent Lesley Stahl reported recently, the intervention, and the crackdown on heavily indebted companies, is part of a wider rollback of free market policies in China. and European investors have largely accepted that their investments in Evergrande may soon be worthless, and while the company's shares are likely to take a huge hit, stock markets in the West have been anticipating the news and are less likely to be rocked.

in its latest financial stability report, saying: "Financial stresses in China could strain global financial markets through a deterioration of risk sentiment, pose risks to global economic growth, and affect the United States."īut CBS News Asia correspondent Elizabeth Palmer reports that U.S.

The Federal Reserve warned of direct risks to the U.S. On Thursday, Fitch confirmed the company had defaulted for the first time on more than $1.2 billion worth of bond debt, as it downgraded the firm's status to a restricted default rating.

The logo of Evergrande Group is seen on the company's headquarters in Shenzhen, Guangdong Province, China, February 9, 2021. Real estate behemoth Evergrande has been the highest profile firm embroiled in the crisis, struggling for months to raise capital to pay off $300 billion in debt. China's government sparked a crisis within the property industry when it launched a drive last year to curb excessive debt among real estate firms as well as rampant consumer speculation.Ĭompanies that had accrued huge debt to expand suddenly found the taps turned off and began struggling to complete projects, pay contractors and meet both domestic and foreign repayments. Beijing - Two major Chinese property firms have defaulted on $1.6 billion worth of bonds to overseas creditors, Fitch Ratings agency said Thursday, as contagion spreads within the country's debt-ridden real estate sector.

0 kommentar(er)

0 kommentar(er)